The Basic Principles Of Business Capital

Wiki Article

The 5-Second Trick For Business Capital

Table of ContentsBusiness Capital for BeginnersGetting My Business Capital To WorkBusiness Capital Can Be Fun For AnyoneThe smart Trick of Business Capital That Nobody is DiscussingThe 4-Minute Rule for Business CapitalTop Guidelines Of Business Capital

You may additionally add more to the balance in your resources account at any type of time during the life of your service, as well as you might additionally take money out of your capital account. There are restrictions on just how much you can secure of your resources account and also when you can take it, based upon the regulating documents of business.When you start a service and desire to take out a bank funding, the bank likes to see that you have actually invested in the organization. If the owner has no risk in the company, they can stroll away and leave the financial institution holding the bag.

The proprietor pays tax obligation on these distributed earnings through their personal tax obligation return, as well as the funding account of each proprietor adjustments by the quantity of the earnings or loss., in two ways: If the shareholder obtains a dividend, it's thought about a funding gain, which suggests capital gains taxes are due.

3 Simple Techniques For Business Capital

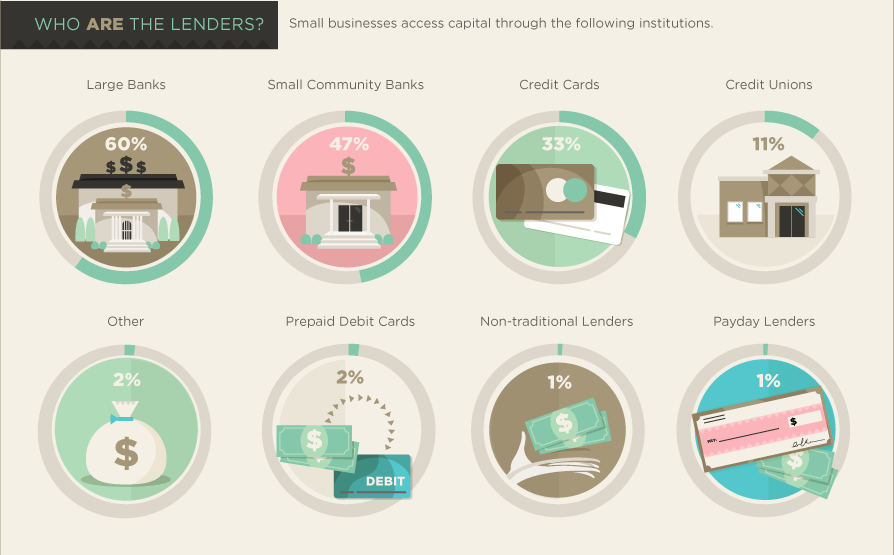

Resources accounts can be complex, and because each business scenario is various and tax legislations are continually transforming, it's finest to speak with tax and lawful consultants before making any business choices.Companies source their resources from different sources. Some of the popular resources of funding are discussed below: Business owners often take small business loan from NBFCs or public financial institutions to resource their capital. Business Capital. This permits them to kickstart their organization and also purchase relevant equipment for production. The repayment and also interests are made via the earnings sustained by the company.

Business properties can be sold off to source capital. Any kind of disposable or surplus asset like land, devices, and so on, can be sold to use the cash as resources for the company.

Fascination About Business Capital

Earnings is the key objective of all business ventures. Without earnings the business will not survive in the long run. Gauging current and also previous productivity as well as forecasting future productivity is really vital. Profitability is determined with earnings and expenses. Income is cash created from the tasks of business.

Cash coming into the service from activities like borrowing cash do not develop earnings. This is just a money transaction in between business and also the lending institution to produce cash for running business or buying properties. Costs are the cost of sources made use of up or taken in by the tasks of the service.

Some Of Business Capital

Payment of a loan is not a cost, it is just a cash transfer in between the company and also the lending institution. This is essentially a listing of earnings and also expenses during a period of time (usually a year) for the whole company.An Earnings Statement is typically made use of to measure profitability of business for the past accounting period. A "pro forma earnings statement" actions projected profitability of the business for the upcoming accounting duration. A budget may be made use of when you desire to predict earnings for a certain job or a part of a service.

Little Known Questions About Business Capital.

Commonly farmers have used the "cash money approach" of accountancy where revenue and also costs are reported on the earnings statement when items are marketed or inputs are spent for. The money method of audit, made use of by the majority of farmers, counts an item as an expenditure when it is acquired, not when it is utilized in the service.Nevertheless, numerous non-farm business audit systems count a thing as an expenditure only when it is actually made use of in business activities. However, take-home pay can be misshaped with the money method of bookkeeping by offering greater than 2 years crops in one year, selling feeder animals bought in a previous year, as well as investing in production inputs in the year prior to they are needed.

With this method, earnings is reported when items are produced (not when they are sold) and also expenses are reported when inputs are used (not when they are bought). Amassing audit utilizes the view it standard cash money method see of bookkeeping during the year yet includes or subtracts stocks of farm items and also production inputs available at the beginning and also ending of the year.

Getting The Business Capital To Work

Typically, farm profits have actually been calculated by utilizing "accounting profits". To understand audit earnings, think about your revenue tax obligation return. Your Schedule F offers a listing of your gross income as well as deductible expenditures. These are the very same products used in computing accountancy profits. Your tax obligation declaration may not give you an exact picture of productivity due to IRS quick devaluation and various other aspects.

If you were not farming, you would have your cash spent somewhere else as well as be employed in a various job. redirected here Chance expense is the investment returns provided up by not having your cash invested somewhere else and incomes surrendered by not functioning in other places. These are deduced, in addition to average company costs, in calculating economic earnings.

Report this wiki page